-

Company

-

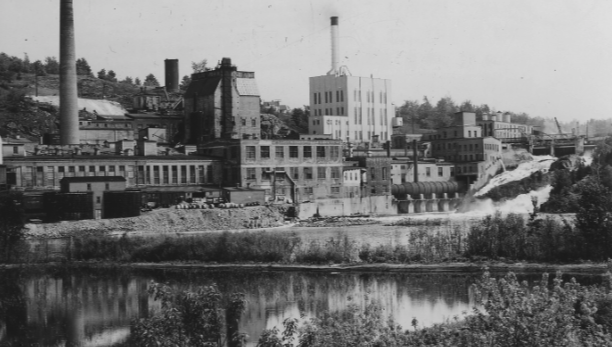

151 Years in Business

Since 1872, Kimberly-Clark’s 45,000 employees around the world are...

Keep Reading -

Company

Explore All

-

-

Brands

-

Our Safety Commitment

Kimberly-Clark has a long history of providing products that improve the health, hygiene, and well-being of people everywhere.

Keep Reading -

Brands

Explore All Brands

-

-

Investors

-

2022 Annual Report

Fueled by ingenuity, creativity, and an understanding of people’s most essential needs, Kimberly-Clark and its trusted brands are an indispensable part of life for people in more than 175 countries...

Keep Reading -

Investors

Explore All

-

-

Sustainability

-

Purpose-Led Brands Making Lives Better

Kimberly-Clark and its trusted brands, including Huggies®, Kleenex®, Andrex®, Cottonelle®, Scott®, Kotex® and...

Keep Reading -

Sustainability

Explore All

-

-

Careers

-

Inclusion and Diversity

For more than a century we’ve thrived as an organization by helping individuals thrive through the talents and energy that make them unique...

Keep Reading -

Careers

Explore All

-

-

Newsroom

-

Kimberly-Clark Ranked No. 2 on Barron’s 100 Most Sustainable Companies List for 2024

As we continue to make progress toward our global goal to halve our environ-mental footprint by 2030, we impro...

Keep Reading -

Newsroom

Explore All

-

-

- Global Locations